In today’s digital economy, small businesses require efficient and secure payment solutions to thrive. PayPal has emerged as a leading payment platform, revolutionizing how small businesses manage transactions. Here, we’ll explore the myriad benefits of PayPal for small businesses, highlighting its ease of use, security features, and seamless integration capabilities – including how to connect PayPal to the Ruoom appointment software tool.

The dynamic landscape of the digital economy

Small businesses need reliable and user-friendly payment solutions to fuel their growth. A prominent player in the payment industry, PayPal has revolutionized how small businesses manage their transactions. There are many advantages that PayPal offers to small businesses, and we’ll delve into its ease of use, robust security features, and seamless integration capabilities.

Ease of Use

One of the primary reasons small businesses opt for PayPal is its user-friendly interface and intuitive design. Setting up a PayPal account is a straightforward process that requires minimal technical expertise. The platform offers a seamless payment experience for customers, allowing them to make purchases with just a few clicks. By leveraging PayPal’s simplicity, small businesses can enhance customer satisfaction and minimize cart abandonment rates, ultimately boosting sales and revenue.

Security Features

Security is critically important when it comes to online transactions. PayPal recognizes this concern and has implemented robust security measures to safeguard sensitive financial information. The platform employs advanced encryption technologies and fraud detection systems to protect businesses and customers from unauthorized access and fraudulent activities. With PayPal’s secure infrastructure, small businesses can instill trust in their customers and ensure a safe payment environment, fostering long-term relationships and repeat business.

Payment Flexibility

PayPal offers small businesses various payment options to cater to diverse customer preferences. Customers can make payments using their PayPal balances, credit cards, or bank accounts. Additionally, PayPal supports various currencies, making it an ideal choice for global businesses. By providing customers with flexible payment options, small businesses can easily attract a more extensive customer base, expand their reach, and tap into new markets.

Seamless Integration

Integrating PayPal into existing business systems is a breeze, thanks to its extensive integration capabilities. Whether it’s an e-commerce website, a point-of-sale (POS) system, or an invoicing tool, PayPal seamlessly integrates with popular platforms, allowing businesses to streamline their operations and automate payment processes. This integration versatility enables small businesses to efficiently manage their finances, track transactions, and reconcile payments, saving valuable time and resources.

Enhanced Customer Trust

PayPal’s widespread recognition and reputation as a trusted payment provider instill customer confidence. Many shoppers prefer using PayPal due to its buyer protection policies, which offer refunds and dispute resolution services. By accepting PayPal, small businesses can leverage this trust factor to attract new customers and build credibility in the online marketplace. Additionally, displaying PayPal logos and badges on websites and marketing materials can serve as visual cues that reassure customers of secure and reliable payment options.

Did you know there are 29 million merchant accounts on PayPal as of 2023?

How to connect PayPal to Ruoom

Are you using PayPal to accept payments for your small business? Let’s walk you through connecting your business PayPal account to Ruoom.

But before we get started please note, You must have a PayPal Business Account in order to process payments.

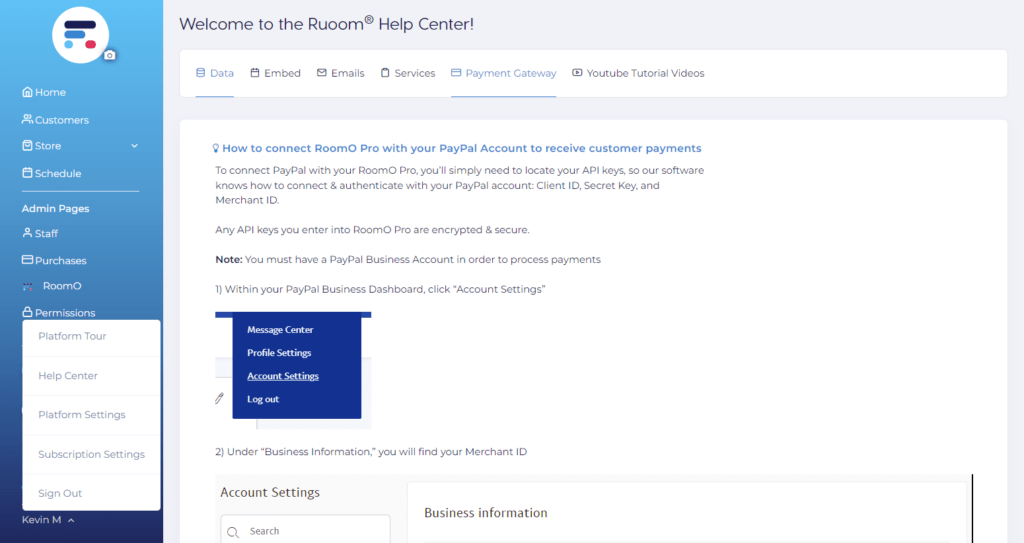

To connect PayPal with your Ruoom, you’ll simply need to locate your API keys, so our appointment software knows how to connect & authenticate with your PayPal account. Any API keys you enter into Ruoom are encrypted & secure.

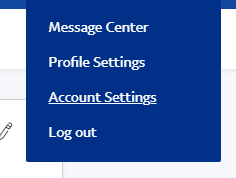

1. Within your PayPal Business Dashboard, click Account Settings.

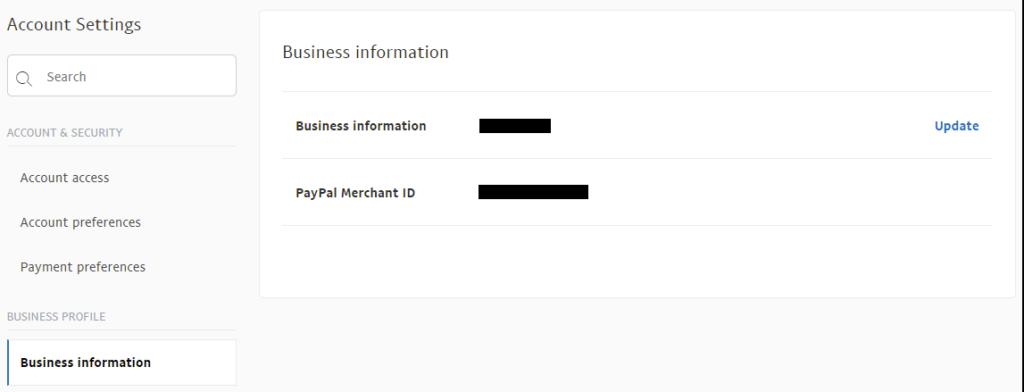

2. Under Business Information you will find your Merchant ID.

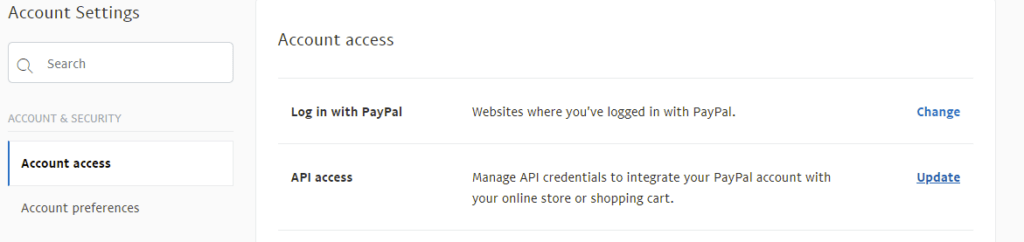

3. Under Account access, select API access > Update.

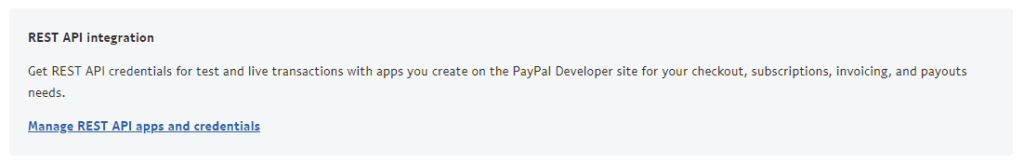

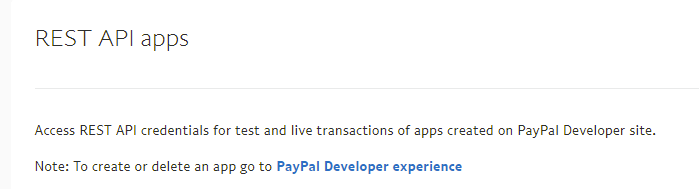

4. Select Manage REST API apps and credentials.

5. Select PayPal Developer experience.

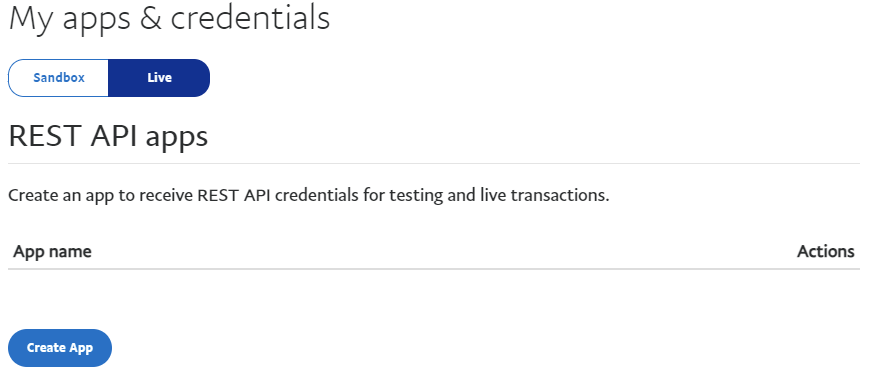

6. Select Live and Create App

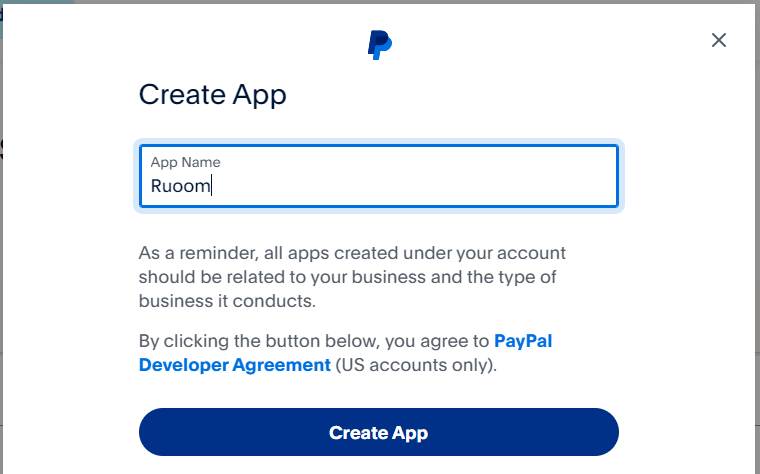

7. Type whatever you like as your new app name but we suggest ‘Ruoom’, to make it easy to identify later.

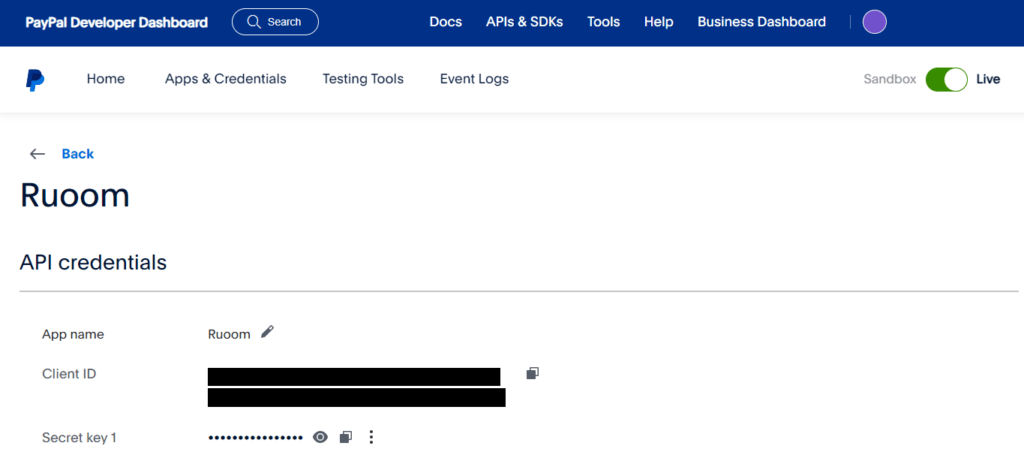

8. You will immediately see your Client ID and Secret Keys.

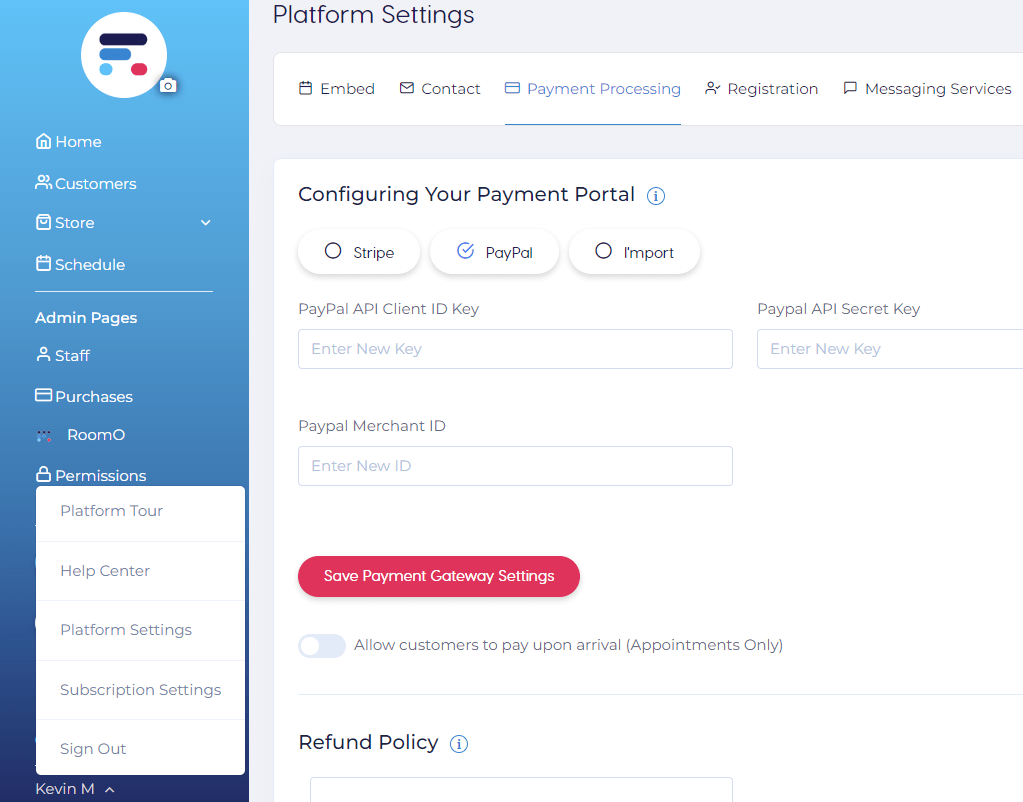

9. Finally, within your Ruoom Platform Settings page, enter the Merchant ID, Client ID, and Secret Key.

You’re done! You can now begin using your PayPal Business Account to accept payment through the Ruoom customer management software.

One more thing…

Don’t worry about bookmarking this blog post when you’re ready to set up PayPal or anything related to your small business. Each Ruoom subscription includes a Help Center full of how-to guides and a few Youtube tutorials, which we update frequently.

To find the Help Center, click on your name then Help Center.

PayPal has emerged as an indispensable payment solution for small businesses in the digital era. With its user-friendly interface, robust security features, flexible payment options, seamless integration capabilities, and enhanced customer trust, PayPal empowers small businesses to manage transactions efficiently and drive growth. By embracing PayPal, small businesses can unlock the benefits of a trusted and versatile payment platform, positioning themselves for success in the competitive online marketplace.

Read More: